by Heather Siegel ’12

Californians watched this summer as Stockton, Mammoth Lakes, and San Bernardino filed for bankruptcy in rapid succession, prompting headlines like “California is Ground Zero for Muni Bankruptcies.” Each of these cities had unique circumstances that led them to declare bankruptcy, but they also suffered from many of the same problems that are endemic among California cities and counties. Municipalities across the state are locked into staggering pension liabilities and expensive labor contracts at the same time that tax revenues have fallen due to a sluggish housing market, a weak economy, and changes in state policy. According to an August 17 report from Moody’s Investor Services, more than 10 percent of California’s 482 cities have declared fiscal crises. For cities in the worst financial situation, the bankruptcy process provides a legal framework to reorganize their debts and negotiate an orderly plan to repay creditors. Bankruptcy can also force the political will necessary for politicians, government officials, and residents to make difficult, painful decisions that address deep-rooted fiscal, political, and structural problems, and give cities an opportunity for a fresh start.

During the good times in the mid-2000s, city officials across California spent property tax and redevelopment funds freely, financing large-scale civic improvement projects and entering into generous long-term contracts with public sector unions, obligations that they could not easily undo when revenues fell. Stockton, for instance, borrowed extensively to finance projects like a new marina, high-rise hotel, and promenade in an effort to reinvent itself as a more upscale city and a popular site for conventions. Cities also signed generous contracts with public sector unions, locking in high wages and lifelong benefits, including healthcare and guaranteed pensions. Pension costs for San Bernardino will reach $25 million this year, double the 2006 level. As tax revenues fell during the recession and cities found it increasingly difficult to continue fulfilling their promises to current and former employees, the unions largely refused to compromise and renegotiate their lucrative contracts. Moreover, public pension funds including CALPERs experienced significant investment losses, further increasing cities’ unfunded pension liabilities. State law protects union contracts and makes it difficult for a city to renegotiate them. The only way to amend collective bargaining agreements is for a city either to file for bankruptcy or officially declare a fiscal emergency. During bankruptcy, the city negotiates with all of its creditors, dealing with each class “fairly and equitably.” A declaration of fiscal emergency, meanwhile, permits the city to renegotiate collective bargaining agreements and amend public employee benefits when doing so will help the city fulfill its responsibility to protect the lives, health, morals, comfort, and general welfare of the public. Both alternatives create political problems, and unions are often willing to wage expensive legal battles with struggling cities rather than accepting impairment of their contracts.

Municipal finances for cities across California have also suffered in recent years when important sources of revenues fell, notably property taxes, vehicle license fees, and redevelopment funds. Property taxes are a significant source of tax revenue that account for 25 percent of total revenues raised by California cities. However, the Great Recession demonstrated that property tax revenue can also be extremely volatile. California experienced a huge housing boom between 2001 and 2007 and a corresponding growth in property tax revenues when cheap financing facilitated extensive investment and speculation in the housing market. Regions with extensive open land and few growth controls like the Inland Empire and Central Valley experienced the largest growth, and were therefore especially hard-hit when the housing market turned sour in 2008. While home prices across the country fell by 24 percent from 2005 to 2010, they fell by approximately 60 percent in Riverside, Stockton, and Modesto. During the recession, these areas also experienced a foreclosure rate that was three to four times higher than the national average, further eroding their property tax base and depressing home values. Proposition 13, meanwhile, constrained the cities from making up this lost revenue by increasing property tax rates. The 1978 constitutional amendment pegs the statewide property tax rate to 1 percent of the sale price of the property and limits annual increases to 2 percent so long as the property is not sold.

Municipal finances for cities across California have also suffered in recent years when important sources of revenues fell, notably property taxes, vehicle license fees, and redevelopment funds. Property taxes are a significant source of tax revenue that account for 25 percent of total revenues raised by California cities. However, the Great Recession demonstrated that property tax revenue can also be extremely volatile. California experienced a huge housing boom between 2001 and 2007 and a corresponding growth in property tax revenues when cheap financing facilitated extensive investment and speculation in the housing market. Regions with extensive open land and few growth controls like the Inland Empire and Central Valley experienced the largest growth, and were therefore especially hard-hit when the housing market turned sour in 2008. While home prices across the country fell by 24 percent from 2005 to 2010, they fell by approximately 60 percent in Riverside, Stockton, and Modesto. During the recession, these areas also experienced a foreclosure rate that was three to four times higher than the national average, further eroding their property tax base and depressing home values. Proposition 13, meanwhile, constrained the cities from making up this lost revenue by increasing property tax rates. The 1978 constitutional amendment pegs the statewide property tax rate to 1 percent of the sale price of the property and limits annual increases to 2 percent so long as the property is not sold.

Since 1986, vehicle license fees (VLF) were a constitutionally protected source of local revenue. In 2004, however, the state of California introduced a VLF-for-property tax swap that resulted in a net loss for many smaller Inland Empire cities that heavily relied on these revenues to finance public safety functions. Over the last eight years, the small cities of Jurupa Valley, Wildomar, Eastvale, and Menifee alone lost $16 million in VLF revenue that could have gone toward law enforcement and fire services. In 2011, SB 89 further reduced the VLF revenue that newly-incorporated cities receive, costing them millions of dollars. In several cases, these lost revenues represent as much as a quarter of the city’s entire general fund.

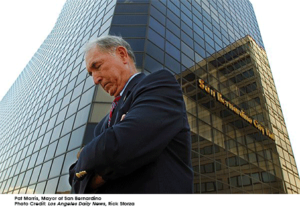

Cities also lost millions in redevelopment revenues when redevelopment areas (RDAs) were officially dissolved on February 1, 2012. (See “Redevelopment Authorities Under Fire” in the Spring 2011 Inland Empire Outlook.) In the short term, cities lost a revenue stream that they had come to rely on to help finance a wide variety of municipal functions, including economic development, park maintenance, planning, and even city councils – activities that were not always directly connected to redeveloping blighted areas. Long term, some fear that the loss of redevelopment areas will hurt cities by making it more difficult to remove blight, raise property values, and grow the cities’ tax base. Chris McKenzie, the executive director of the League of California Cities, said, “Cities depended on redevelopment to make additional dollars in property and sales taxes down the road, and they were spending down their reserves in the meantime.” The City of San Bernardino will lose $30 million a year in RDA funds, including $6 million it was improperly using to back fill its general fund. Mayor Patrick Morris announced, “One might say it was the nail on the coffin in terms of our unbalanced budget.” Along with straight forward development projects such as the city’s minor league baseball stadium and renovated historic theatre, San Bernardino also used its redevelopment revenue to fund items less clearly related to development such as its public access television station. Moreover, it used redevelopment funds to pay citywide operating expenses including the salaries of the city manager, code enforcement officers, human resources staff, the city clerk, and the city attorney.

The cities of Stockton and San Bernardino are both struggling with enormous budget shortfalls resulting from large obligations and falling revenues. Stockton’s City Council identifies “unsustainable retiree health insurance commitments” dating back to the 1990s and “unsustainable and unsupportable labor contracts” as two of the most important factors that brought the city to the verge of bankruptcy. Stockton has an annual budget of $521 million, and owes $417 million in retiree health benefits. The City Council also points out that poor fiscal management practices contributed to the city’s financial problems. Stockton issued a large amount of outstanding debt in the early 2000s to finance municipal projects, assuming that hyper growth would continue indefinitely and the city would be able to repay its creditors easily. On the revenue side, Stockton’s income from property taxes, vehicle license fees, and redevelopment funds fell after the recession hit. Stockton’s housing market was one of the hardest-hit in the country, and the city had the highest foreclosure rate in the country in the first half of 2012. High unemployment also contributed to the erosion of the city’s tax base; Stockton’s unemployment rate was 15.1 percent in July 2012, almost twice the national rate of 8.6 percent. The city has tried to deal with its budget shortfall by reducing expenses. Since 2009, it has cut $90 million in spending and eliminated 25 percent of its police officers, 30 percent of its fire department, and 40 percent of other city employees. Even after imposing these cuts, Stockton defaulted on several debt payments in early 2012 and had four buildings – including its future city hall – repossessed by Wells Fargo. As of July 1, 2012 Stockton was facing a $26 million budget shortfall and had run out of programs to cut.

The facts behind the Mammoth Lakes bankruptcy filing are somewhat different. Like Stockton and San Bernardino, Mammoth Lakes is also running a budget deficit, $2.7 million in 2011-12 and $2.8 million projected for 2012-13. However, in addition to the budget shortfall, Mammoth Lakes also owes $43 million to Mammoth Lakes Land Acquisition in a breach-of-contract judgment. The award is nearly three times the size of the town’s annual operating budget. The Mammoth Lakes Town Council voted on July 2, 2012 to authorize the bankruptcy filing. This followed an attempt to mediate the judgment that failed because Mammoth Lakes Land Acquisition refused to participate. Negotiations, however, continued through the summer and on September 21, 2012 the town made public the terms of a $29.5 million settlement.

San Bernardino’s financial situation appears to be grim. Following its declaration of bankruptcy on August 1, 2012, the Wall Street Journal reported that San Bernardino was running a $45 million dollar deficit on a $130 million budget. With workers and retirees unwilling to renegotiate contracts and benefits, the city has cut its workforce by 20% in the last four years. Despite these cuts, the city projects $45 million annual deficits for the next five years. According to the city attorney the scale of the city’s financial problems were hidden by falsified budget reports for many years. Members of the city council reject that allegation. While San Bernardino’s housing market shows early signs of recovery, see The Inland Empire Housing Market on a Path of Moderate Recovery, p.14, its 12.7 percent unemployment rate points to continued trouble for the city’s economy and near-term fiscal future.

Bankruptcy offers individuals, businesses, and local governments that can no longer pay their creditors an opportunity to resolve or renegotiate their debt and thereby obtain a fresh financial start. The U.S. Bankruptcy Code provides for six different types of bankruptcy. Municipalities, which include cities, towns, counties, taxing districts, municipal utilities, and school districts, file under Chapter 9 (Adjustment of Debts of a Municipality). According to the Congressional Research Service, “The focus of Chapter 9 is not necessarily to attempt to balance the rights of the debtor and its creditors but to meet the needs of a municipal debtor.” The U.S. Bankruptcy Code respects municipalities’ sovereignty by granting them several rights and privileges as they work to resolve their financial difficulties. While creditors may force individuals and businesses into bankruptcy, they cannot compel municipalities to file under Chapter 9 or propose alternative reorganization plans. The municipality itself must weigh its options and decide whether bankruptcy provides the most viable pathway toward resolution of its financial difficulties. The court cannot force municipalities to sell their assets or increase tax rates in order to raise revenues, and municipalities may continue to borrow money throughout the bankruptcy process. Finally, the court cannot require municipalities to dissolve or reorganize their governance structure. Throughout the process municipalities are responsible for providing a variety of essential services to their constituents. The court cannot interfere with a municipality’s basic governmental functions and cannot usurp officials’ power to make internal political and fiscal decisions. Finally, filing for bankruptcy does not relieve a municipality of its governmental responsibilities under state and federal law. Phil Batchelor, the former interim city manager of Vallejo, explained, “When you declare bankruptcy, you don’t suddenly get a free pass that allows you to abdicate responsibilities for providing municipal services.”

Chapter 9 offers municipalities protection from their creditors while they develop recovery plans to achieve financial stability. According to the Congressional Research Service, “The paramount feature of a municipal reorganization is the requirement that the municipal debtor and a majority of its creditors reach an agreement on a plan to readjust the municipality’s debts.” Many municipalities going through bankruptcy will restructure their debts by renegotiating contracts (especially those with public employee unions), extending debt maturities, reducing the amount of principal or interest, and/or refinancing the debt. Under Chapter 9, municipalities have considerable latitude in developing a reorganization plan that accommodates their unique economic and political conditions; however, the municipalities’ creditors must approve the plan before it can go into effect. The court can also “cram down” a plan over the objection of some impaired creditors, as long as one class of impaired creditors approves the plan and the court finds that it “does not discriminate unfairly, and is fair and equitable, with respect to each class of claims or interests that is impaired under, and has not accepted the plan” (11 U.S.C. § 1129(b)(1)). Municipalities have no guarantee, though, that their reorganization plan will be approved or that they will successfully emerge from bankruptcy. The Congressional Research Service warns, “The outcome of any reorganization cannot be predicted with certainty.”

Although bankruptcy can offer municipalities a way out of dire financial straits, it is a long and expensive process with lasting economic, political, fiscal, and public relations consequences. Andrew Morris, of Best Best & Krieger, has had firsthand experience with Chapter 9 as Mammoth Lakes’ town attorney, and cautions, “Bankruptcy is not a silver bullet, it’s not a panacea.” Frank Adams, also at Best Best & Krieger and specializing in bankruptcy, elaborates, “Typically, if I sit down with a debtor to interview them for some type of bankruptcy proceeding, I want to make sure that they understand that it’s a last resort. Once they’ve been to bankruptcy court, there’s really nowhere else to go.” Already broke cities can expect to spend millions of dollars over the course of their bankruptcy on legal fees and financial experts. The City of Vallejo spent approximately $11 million in attorneys’ fees alone. Even after municipalities emerge from Chapter 9, they pay an ongoing cost in the form of significantly higher interest rates. Cities going through bankruptcy, including Vallejo and Mammoth Lakes, have had their municipal bond ratings downgraded to junk or near-junk status, making it extremely difficult for them to borrow funds to finance government activities or invest in the community. Having exhausted other options, even after emerging from bankruptcy in November 2011, the still-struggling city of Vallejo had to raise its sales tax from 7.3 percent to 8.3 percent.

Bankruptcy is a disruptive process and can taint the public’s perception of the community, causing further economic hardship. The process creates uncertainty, making the community less attractive to businesses. In August, Starbucks’ Evolution Fresh announced that it was relocating its 120-employee manufacturing facility from bankrupt San Bernardino to nearby Rancho Cucamonga. The company turned down offers from city officials to help them find an appropriate new building within San Bernardino. Andrew Morris observed, “People don’t understand what bankruptcy means.” When a municipality declares bankruptcy, residents do not know what to expect. Many wonder whether the local government will continue to maintain parks, sweep the streets, or effectively deal with crime. In the case of Mammoth Lakes, bankruptcy has really hurt the town’s tourism industry. Morris said, “Mammoth is a resort town, and the hoteliers and the people doing tourism promotion have actually gotten a lot of questions from people: ‘Are the mountains still in existence? Is the resort still going to be there? Can we still come?’” According to Bloomberg, 61 percent of Mammoth Lakes’ general fund revenue comes from hotel taxes; a weaker tourist season will make it even more difficult for the town to improve its financial situation and repay its creditors.

Most municipalities will try to avoid bankruptcy by taking steps such as negotiating with creditors, seeking concessions from employee groups, and restructuring municipal government. Some smaller struggling cities, such as Jurupa Valley, have floated the idea of disincorporation as a possible alternative to filing for Chapter 9. When a city disincorporates, the municipal government’s responsibilities such as public safety are assumed by the county. In practice, disincorporation is rarely a realistic alternative for municipalities. It is a long and difficult process, further complicated by the old laws’ failure to take into account many realities of contemporary California government such as Proposition 13. Twenty-five percent of residents must sign a petition to commence the disincorporation process, and the county must agree to accept the city government’s duties. Residents in Jurupa Hills, Eastvale, Menifee, and Wildomar fought hard to incorporate their cities within the last five years, and there is unlikely to be widespread support for disincorporating in the face of financial challenges. Residents, businesses, and government officials like to see their tax dollars remain within the community, and incorporated cities are the best way to ensure local control over spending decisions, public safety, schools, and other community activities.

Most municipalities will try to avoid bankruptcy by taking steps such as negotiating with creditors, seeking concessions from employee groups, and restructuring municipal government. Some smaller struggling cities, such as Jurupa Valley, have floated the idea of disincorporation as a possible alternative to filing for Chapter 9. When a city disincorporates, the municipal government’s responsibilities such as public safety are assumed by the county. In practice, disincorporation is rarely a realistic alternative for municipalities. It is a long and difficult process, further complicated by the old laws’ failure to take into account many realities of contemporary California government such as Proposition 13. Twenty-five percent of residents must sign a petition to commence the disincorporation process, and the county must agree to accept the city government’s duties. Residents in Jurupa Hills, Eastvale, Menifee, and Wildomar fought hard to incorporate their cities within the last five years, and there is unlikely to be widespread support for disincorporating in the face of financial challenges. Residents, businesses, and government officials like to see their tax dollars remain within the community, and incorporated cities are the best way to ensure local control over spending decisions, public safety, schools, and other community activities.

The United States Bankruptcy Code sets four eligibility requirements for Chapter 9. The first is that the “municipality must be specifically authorized to be a debtor by state law.” This provision allows states to set additional conditions that municipalities must meet to be eligible for bankruptcy. Until last year California did not impose any. However, in October 2011, California passed AB 506 to “prohibit a local public entity from filing under federal bankruptcy laws unless the local public entity has participated in a neutral evaluation process with interested parties.” Democratic Assembly Member Bob Wieckowski introduced this bill with the full support of the California Labor Federation and other union groups wary of being forced to accept contract changes through the bankruptcy process. The new law requires municipalities on the verge of bankruptcy to participate in a 60-day mediation process with their creditors, giving unions a stronger voice in the bankruptcy process. Andrew Morris, Mammoth Lakes’ town attorney, said, “If you do it right, [these negotiations] can be an opportunity rather than a challenge.” The city of Stockton became the first municipality to go through this state-mandated mediation earlier this year. After 90 days of tedious negotiations, dubbed “Death by a Thousand Meetings,” Stockton failed to reach an agreement with its 18 creditors. AB 506 adds another hurdle to the already complicated bankruptcy process, but the mediation process could benefit Stockton long-term by making the actual bankruptcy proceedings more efficient and helping the city avoid the string of lawsuits from creditors that Vallejo had to deal with during its own bankruptcy. As Jon Holtzman, one of Stockton’s lead attorneys, said to the Los Angeles Times, “It was a very expensive process, but I’m really of the view that it was somewhat successful. It got everyone on the same page and there was a clear detailed view of the city’s finance. Most of the unions got it.”

AB 506 also includes a provision allowing insolvent municipalities to bypass the state-mandated mediation period by declaring a fiscal emergency. On July 18, San Bernardino became the first city to take advantage of this provision, stating that without bankruptcy protection, the city will be unable to meet its financial obligations within 60 days. Bloomberg reported the following day that San Bernardino had depleted its general-fund reserves, lost access to capital markets, and had its Walls Fargo credit lines frozen. San Bernardino’s declaration of fiscal emergency led observers to conclude that its financial situation was even worse than Stockton’s.

San Bernardino’s declaration of fiscal emergency and Chapter 9 filing are just the first steps in a long and arduous process. Taxpayers, creditors, bond holders, credit rating entities, and policy makers will be watching closely as San Bernardino continues down that path.

Sorry, comments are closed for this post.