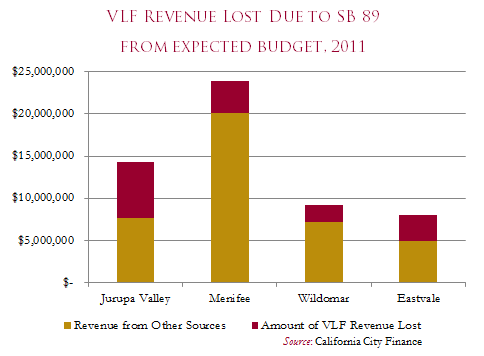

Following the passage of SB 89 in 2011, the four newly incorporated cities of Jurupa Valley, Menifee, Eastvale, and Wildomar in Riverside County faced drastic cuts in state funding. The vehicle license fee (VLF) revenue expected from the state was reallocated elsewhere, leaving considerable gaps in municipal budget plans. For the 2012-2013 fiscal year, these cuts totaled an estimated $15.7 million, threatening these cities’ fiscal viability and even their continued existence. They have led to continued reliance on county services, which are frequently minimal, or substantial cuts in the city workforce.

The city most affected by these cuts has been Jurupa Valley, the last of the four to incorporate. Opening for business only two days before the legislature passed SB 89, it was particularly vulnerable. Jurupa Valley lost 47% of its expected revenue the first year that SB 89 was in effect, and was behind only Los Angeles for the total dollar amount withdrawn. On an annual basis, the VLF allocation would have been about 35% of revenue. In response to the drop in revenue, Jurupa Valley has cut law enforcement services, restructured debt payments to Riverside County, and kept city hall staffing at a minimum. According to Stephen Harding, the first city manager of Jurupa Valley, the city’s operating budget of $18 million should be at least $35 million. If funding remains at current levels the city risks becoming insolvent by mid-2015.

Menifee has also seen a decline in services. For the 2012-2013 fiscal year, the city’s Comprehensive Annual Financial Report (CAFR) estimated that Menifee lost about $4 million due to SB 89. According to Mayor Scott Mann, this constitutes 17% of the general fund budget, assuming estimated losses of $4.5 million. The city has managed these cuts by laying off 14 deputies and has seen the near-elimination of an off-road vehicle team.

Eastvale and Wildomar have gotten through the cuts with the least amount of pain. Both cities have been able to transition slowly from Riverside County support services as planned. In Eastvale, the city finances are helped by a higher than projected sales tax revenue and an amended property tax allocation factor. Sales tax revenue increased by nearly $2 million from fiscal year 2011-12 to fiscal year 2012-13, and negotiations with Riverside County on the method for deriving property tax allocation resulted in $483,427 in additional revenue. Nevertheless, Eastvale continues to lose approximately $3.4 million because of SB 89. Wildomar, which is running a surplus of roughly $1.5 million, has adjusted by cutting expenditures by $2,030,718, but not to the same service level as Jurupa Valley. The city’s most recent CAFR estimated that $1.8 million was lost every year because of SB 89. Working with the Riverside County for an eight-year extension of debt payments for county services during the transition from unincorporated area to city has also helped.

SB 89’s overall purpose was to help pay for Governor Jerry Brown’s 2011 prison realignment plan, which shifted responsibility for certain offenders from the state to the counties. Much of the realignment focused on public safety, but greater mandates for county and city governments required greater funding, and the VLF was a superb source. Prior to SB 89, VLF revenues were divided between administrative expenses for the Department of Motor Vehicles, Orange County (a continued effect of its 1994 bankruptcy), and cities for general purposes. SB 89 raised the motor vehicle registration fee by $12, which covered $300 million in administrative expenses for the DMV. Cutting the VLF allocation to Orange County and cities allowed the state to free up additional money to use for local law enforcement grants necessary for realignment. The LAO estimates that the change in VLF allocation will save the state $453 million in General Fund expenditures for realignment.

The four cities, incorporating after 2004, were substantially more vulnerable than other cities in California. Most cities had seen their VLF allocation change in 2004 as a result of the property tax swap, but that deal was never offered to new cities, or to areas that incorporated inhabited areas. While there was a fix offered in 2006, it was eliminated in 2011 with SB 89. To most cities, SB 89 presented a manageable inconvenience, but it devastated the budgets of these four new cities. This article analyzes the effect of SB 89 on two metrics. First, how it affects state goals of incorporation, and second, how it fits into current spending priorities, particularly public safety realignment.

Incorporation in California

Originally passed in 1935, the VLF took the place of property tax on cars. Following the passage of Proposition 13 in 1978, the state began keeping the VLF revenues that had previously been shared by state and county governments. By 1986, opposition had crystallized in the form of Proposition 47, which specified that VLF revenue, or its successor, had to go to cities and counties. It passed with 82% of the vote. The state, nevertheless, kept the authority to alter the tax rate, assessment schedule, and the allocation of revenues among cities and counties. From 1999 to 2004, the legislature gradually decreased the VLF from 2% to 0.65% of the value of a vehicle. This was offset, or backfilled, from the state’s General Fund until 2004. At that time, the legislature enacted the “VLF-property tax swap,” which substituted VLF revenue for property tax revenue that had previously gone to the Educational Revenue Augmentation Fund (ERAF). Property tax would grow every year with the change in assessed valuation in each jurisdiction. Overall, cities have profited enormously from this switch, gaining upwards of $2 billion in additional revenue.

There were concerns from city governments about this swap, specifically that the state would change the funding formula. As a result, cities pushed Proposition 1A in 2004, which did two things to protect cities. First, it prevented the legislature from reducing any additional property tax received by cities as a replacement for the VLF. Second, it prevented the legislature from reducing the VLF without replacing the lost revenue to cities and counties. This cemented the amount of revenue existing cities would receive, but unintentionally left new cities vulnerable to the variable funding levels from the state.

Following the swap, there was no compensating property-tax-in-lieu-of-VLF for newly incorporated cities or annexations of inhabited areas. By also deleting the seven-year boost of additional VLF revenue, designed to help encourage incorporation, annexation and incorporation became financially infeasible. In 2006, AB 1602 was passed to address the issue. Beginning with an annexation or incorporation after August 5, 2004, cities would receive an allocation of additional revenue coming out of the remaining VLF revenues. Instead of the seven-year augmented revenue, cities now received five years, calculated by an artificially inflated population factor. Originally set to expire on July 1, 2009, SB 301 eliminated the sunset provision on additional VLF revenues. This, however, became irrelevant in 2011 with the passage of SB 89.

VLF revenues to cities are only one aspect of a broader issue of municipal incorporation that goes back several decades. Beginning in the 1950s, California cities began to take advantage of the Lakewood Plan, where they could contract with counties for a wide variety of municipal services. While lowering the costs of incorporation, this was also a source of revenue for counties. This fiscal incentive to incorporate was compounded by the 1955 Bradley Burns Uniform Local Sales Tax, which created a uniform sales tax rate. By incorporating, cities were able to siphon money away from counties. In 1978, California voters passed Proposition 13, commonly known for capping property taxes, which had an unexpected effect on municipal incorporation. Before Proposition 13, cities had been able to raise property taxes with a simple majority vote. When control over property tax revenue shifted to the state, property owners could be more secure that a newly formed city would not raise their property taxes. Thus, incorporation improved the fiscal standing of property owners.

Beginning in the 1980s, the calculations that had encouraged incorporation began to change. New incorporations were diverting revenue from already starved county governments. This was particularly true when a more affluent community formed a new city, as high-revenue, low-need areas ceded, worsening the county’s fiscal situation. In the early 1990s, a combination of decreased defense spending and a crashing housing market led to an economic downturn in the state. This led to the passage of the revenue neutrality law in 1992, which mandated that all future incorporations be “revenue neutral,” meaning that the incorporation cannot cause fiscal harm to a county or other affected agency. The law attempted to solve the discrepancy between revenue sources and county obligations. Counties have two main obligations. The first is to provide police and fire services to unincorporated areas, and to some cities on a contract basis. Second, counties also provide the infrastructure of the criminal justice system – district attorneys, public defenders, correctional facilities – as well as social services and public health services, which are available to all county residents regardless of residence.

The revenue neutrality law has led to a marked drop in incorporations. Previously, many cities were able to incorporate if they had the desire, but that has been narrowed to only two types of cities: relatively affluent cities with high revenue and low service needs and cities with a substantial commercial or retail activity, giving them a sufficient sales tax revenue base. In the period following the enactment of the revenue neutrality law, VLF allocations had become critically important for many of these cities, as it was the only means to fund initial costs. SB 89 eliminated two aspects of the VLF allocation that were key to the city. The first was the allocation that most cities no longer received, having swapped it out for property tax revenue in 2004. The second was an additional allocation that new cities got, exclusively through VLF. This allocation was good for 5 years, declining gradually over that period. For Jurupa Valley, losing this bump alone meant a loss of several million dollars. As a result, incorporation is now substantially harder for cities.

Incorporation in California has long and varied history. In the postwar era, California saw three full decades where there was an explosion of new municipalities. Since 1992, however, growth of municipalities has slowed to a crawl. Mostly a casualty of funding battles emanating from Sacramento, the virtual halt raises doubts over the state’s future effectiveness at meeting some of its own objectives. More recently, the state has begun shifting responsibilities for programs to counties, particularly with the public safety realignment in 2011. These funding battles, particularly the competition for VLF revenue, continue to drive policy at the state level.

Funding Formulas

The year after the governor signed SB 89, the legislature proposed a fix in AB 1098. This bill would fix the reduced VLF allocations for both newly incorporated cities and cities that had annexed inhabited areas. Nevertheless, Governor Jerry Brown vetoed the bill with a succinct message:

As drafted, this bill would undermine the 2011 Realignment formulas in a manner that would jeopardize dollars for local public safety programs, provide cities new funding beyond what existed under previous law, and would create a hole in the General Fund to the tune of $18 million. Given the current fiscal uncertainties, this is not acceptable.

Taking the broader view of California’s budget, the Governor’s veto protects two things. The first is the counties, who are primarily responsible for the realignment in 2011, and the second is the long-term status of the VLF allocation. The third cited reason, the $18 million budget hole, seems to be more circumstantial than permanent.

In the 2011 realignment plan, the state shifted non-serious, non-violent, and non-sex inmates from state prisons to county jails (See “Prison Realignment” from the Spring 2014 Inland Empire Outlook). This involved the transfer of $6.3 billion to local governments, mostly counties, to carry out their increased responsibilities. Reallocating VLF revenue to counties accounted for about 7% of the total cost of realignment. A side effect of this was to create a divide between the counties and the cities. While cities were hurt by the removal of the VLF (though only a few dramatically), counties benefited immensely. Moreover, counties now had an incentive to keep the funding formulas intact – a change in the formulas could result in the counties being on the hook for more of the realignment costs. For Governor Brown this seems to have been the deciding factor.

In both the Assembly and Senate analyses on SB 89, only one organization offered formal opposition to AB 1098, the California State Association of Counties (CSAC). The organization made two claims. First, the calculation for appropriating VLF revenue to newly incorporated cities and cities that have recently annexed inhabited areas will exceed the $25 million gained by removing the DMV’s appropriation from the Motor Vehicle License Fee Account. Eventually, this would lead to money being taken out of county realignment funding to pay for these cities. Second, the cities would get permanent funding from the VLF. Giving the new cities the startup allocation (a boost in VLF revenue for the first 5 years after incorporation, declining every year), as well as an ongoing allocation, ensures that the bill would remove some of the funding sting from realignment. If, however, a particularly large incorporation were to occur, such as East Los Angeles, it would cause serious reductions in funding for counties.

Governor Brown’s concerns, shared by the counties, center on the issue of mandate claims. Currently, California’s Constitution requires the state to reimburse local governments if it mandates either a new service or a higher level of service. Government Code Section 17556 specifies that the state is free from mandate reimbursements if it increases the amount given to local agencies “specifically intended to fund the costs of the state mandate in an amount sufficient to fund the cost of the state mandate.” More recently, the Commission on State Mandates has interpreted Section 17566 so that the state gets credit for satisfying a mandate claim only if it directly links revenues to a particular mandate. This has been compounded by the passage of Proposition 22 in 2010, which prohibits the state from using VLF revenues for mandates. Together, these create an added risk that the state will be forced to pay local governments additional money. While the issue of mandates was alleviated in 2012 with the passage of Proposition 30, which eliminated the state’s mandate liability, this was not the case five months before the election, when AB 1098 was passed.

SB 89 shifted the VLF revenue from the city governments over to law enforcement. Now, VLF revenue is distributed through grant funding in the Local Law Enforcement Services Account. This has given law enforcement agencies an ability to carry out the demands that realignment has placed upon them. In the four cities where VLF allocation has disappeared, the irony is that these cities have suffered from drastic cuts to their police forces. For them, law enforcement agencies are likely worse off than they were before 2011. For the vast majority of counties, however, the grants given to law enforcement agencies have helped smooth the edges of realignment and put them in a better position.

More recently, bills were brought forward in each chamber to solve the funding problem for the four new Inland Empire cities. In the Assembly, AB 1521 sought to remedy the VLF allocation formula, but only for those cities that have annexed inhabited areas. In the Senate, SB 69 targeted cities that incorporated after January 1, 2004, but before January 1, 2012. AB 1521 proposed taking $5 million in property tax revenue from the ERAF. The amount lost to the ERAF would be backfilled from the General Fund. Over time, the $5 million would grow as property taxes increase. SB 69 gave newly incorporated cities a property tax allocation equal to what they would have received in VLF. In essence, this gave the four new cities the same deal handed to all other cities in 2004. Nevertheless, this only applied to the four cities that incorporated between January 1, 2004 and January 1, 2012. As such, it did not deal with the broader issues of municipal incorporation and whether new cities should be created. Nevertheless, on September 28, the Governor vetoed both bills. His veto message echoed his veto message for AB 1098:

While it is true that the state’s economy has improved markedly, and significant progress has been made in aligning revenues and expenditures, I do not believe it would be prudent to authorize legislation that would result in long term costs to the general fund that this bill would occasion.

The Governor seems primarily concerned with the long-term status of the VLF allocation; it is one of the reasons he gave in his veto message for AB 1521. This raises the central question of the funding problem: if not through the General Fund, then how will these cities be funded? It seems that no matter the source, the General Fund will be affected (it is unlikely that new revenue would be raised exclusively for the purpose of funding these cities, so the funding will have to come from some existing source). For the Governor, this will be the crux of his problem moving forward.

The cities’ problem is both larger and more immediate. Funding shortages risk continued cuts to city services, including public safety. Jurupa Valley in particular will have to find a way to fund operations for the next year, which may not be possible, leading the city to become insolvent. The other cities will suffer financially as well, but have a better chance of getting through these obstacles. As cities consider incorporation, the answer for most will be no. It will remain too difficult, if not impossible, to find the fiscal base to support a new city without assistance from the state.

Want more? Read the rest of the Fall 2014 Inland Empire Outlook here!

Featured image photo credit: Kevin Harris, Flickr

Sorry, comments are closed for this post.