Placed on the Ballot by Petition Signatures

Research Assistant: William Frankel ’21

Purpose

Proposition 5 would allow homeowners who are age 55 or older or severely disabled to transfer the tax assessments value of their prior home to their new home when they move. It expands existing rules to cover all homeowners over age 55 and removes certain geographic restrictions.

Background

Ad valorem property taxes are determined by multiplying the assessed value of a home by the governing property tax rate. The initial “assessed value” of a property is the cost for which it was purchased, or “market value.” In California, each year following the purchase, the property’s assessed value can increase by no more than 2 percent or the rate of inflation, whichever is lower. This appreciation process continues until the property is sold, at which point the county again assigns it an assessed value equal to its most recent sale price.[1]

So, if a couple purchased a home in 2016 for $200,000 in a county with a 1 percent property tax, that couple would pay $2,000 (200,000 times .01) in property taxes. In 2017, the home’s assessed value could rise to $204,000 (200,000 times 1.02), meaning its owners would owe $2,040 in property taxes ($204,00 times .01). If in 2018 the home was then sold again, this time for $250,000, then the assessed value for the new owner would automatically be set to $250,000, their property tax bill would be $2,500 ($250,000 times .01), and come 2019 the home’s assessed value could rise to $255,000 ($250,000 times 1.02).

In 1986, California voters passed Proposition 60. It provided that when homeowners over the age of 55 move, they can transfer the assessed value of their old home to their new one, as long as the replacement home was: of equal or lesser value to the original one; located in the same county as the original one; and purchased within two years of when the homeowner’s sold their original home.[2] Two years later, in 1988, California voters further amended this process by passing Proposition 90, which expanded age 55+ homeowners’ ability to transfer their previous home’s assessed value to their new one. Under Prop 90, 55+ homeowners can also transfer assessed property values during a move across counties, provided that the new home is in a county that has agreed to participate in Prop 90.[3] There are only 11 such counties, and one of them, El Dorado, rescinded its participation in 2017, effective November 8, 2018. They are: Alameda; El Dorado (impending rescission); Los Angeles; Orange; Riverside; San Bernardino; San Diego; San Mateo; Santa Clara; Tuolumne; Ventura.[4]

Moves often result in higher property tax bills for homeowners. Because California home values usually appreciate at more than 2 percent per year, a home’s market value – the price for which it could be sold – is often higher than its assessed value, and the gap tends to expand with time. Thus, by moving into a new home with a market value higher than the assessed value of the previous home, homeowners face a higher property tax bill.[5]

Proposal

Proposition 5 would expand the existing special rules for 55+ homeowners. It also includes a provision to qualify severely disabled homeowners for the same rules. The measure would create the following rules for qualifying homeowners: if a homeowner moves into a replacement home that has the same market value as their original home, the assessed value of the new home would be the assessed value of the prior home. Take, for example, a homeowner whose home has an assessed value of $200,000. Without special rules, if this homeowner sells that house for $250,000 and buys a new for the same price, the homeowner will be responsible for property taxes on the $250,000 market value. Under Prop 5, however, a qualifying homeowner in that hypothetical would continue to have an assessed property value of $200,000, even though their new (and old) home’s market price is $250,000.

If a qualifying homeowner buys a replacement home with a market value greater than their old one, Prop 5 provides a formula for increasing the homeowner’s new assessed property value, which guarantees that the figure will be below the replacement home’s market value, though it will still be greater than the old home’s assessed value.[6] That formula, for when a qualifying homeowner “upgrades” in terms of market value, is as follows:

(Prior home assessed value) + [(new home market value) – (prior home market value)] = (new home assessed value).[7]

In other words, qualified homeowners moving into more expensive houses will have assessed property values equal to their prior home’s assessed value plus the difference between the two homes’ sale prices. Or, colloquially, the old assessed value plus the value of the upgrade.

Conversely, the measure provides another formula for qualified homeowners moving into homes with lower market values than their old ones.[8] It similarly guarantees that qualified homeowners will have lower assessed property values than they would otherwise.

That formula, for when a qualifying homeowner “downgrades,” is as follows:

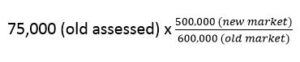

(Prior home assessed value) × [(new home market value) ÷ (prior home market value)][9]

In other words, qualified homeowners moving into less expensive houses will have assessed property values equal to the fraction of the new home’s price over the old home’s price, multiplied by the old home’s assessed value.

Additionally, Prop 5 would notably make these special rules uniform for all of California. Counties could not choose whether to participate, so regardless of where a qualified homeowner moves within the state, they could take advantage of the special rules.[10]

Take the example of the 60-year-old couple who have lived in their home for 30 years and are looking to move.[11] The home’s assessed value is only $75,000, but because the housing market has gotten so expensive since they bought it, they could sell for $600,000.

If, in choosing their new home, they upgrade to a home worth $700,000, the normal system would set their assessed property value to $700,000. Under Prop 5, the couple’s new assessed property value would be only $175,000:

75,000 (old assessed) + 700,000 (new market) – 600,000 (old market).

If, on the other hand, they downgrade to a home worth $500,000, the normal system would set their assessed property value to $500,000. Under Prop 5, the couple’s new assessed property value would be only $62,500:

Fiscal Impact[12]

By reducing the property tax burdens of qualified individuals moving into new homes, Proposition 5 would likely increase the number of homes bought and sold in California. The Legislative Analyst’s Office estimates that annual home sales, between 350,000 and 450,000 in recent years, could increase by as much as tens of thousands.

The effect that this increase in sales volume would have on price, however, is unclear. Because a qualified homeowner deciding to sell his or her old home and purchase a new one increases both the California housing market’s supply and demand by exactly one unit, classical economic models would predict no change in prices.

The reduction in property tax revenues would put additional pressure on both state and local governments. The Legislative Analyst’s Office estimates that in the first few years after Prop 5 goes into effect, total property tax losses in California would net around $150 million annually. These losses would grow over the long run, reaching from $1 billion to a few billion dollars per year in the long term. The losses would most directly affect schools, which are largely funded through property taxes.

Most of these local losses, however, would be offset with state funds. California law guarantees schools a minimum amount of funding each year, such that schools with less money from property taxes receive a larger state subsidy. If property taxes received by schools decrease, state funding to that school must increase. Therefore, the state would be liable for those same lost property tax revenue figures in money allocated to schools: $150 million in early years, rising to more than $1 billion in the long run.

Supporters

Proposition 5 is funded and supported by Homeownership for Families and Tax Savings for Seniors, which is in turn sponsored by the California Association of Realtors. It has spent just under $5.5 million as of June 30.[13] The California Chamber of Commerce has also endorsed the measure.[14] So has the California Republican Party.[15]

Arguments of Supporters[16]

Supporters say Prop 5 would:

- Enable seniors to move into homes closer to their families

- Free up modest-priced and move-up housing for young families

- Reduce the tax burden on seniors, who often live on a fixed income

Opponents

The No on Prop 5 campaign is sponsored by a coalition of groups including advocates for educators, public safety officials, and healthcare organizations.[17] Prop 5 is also opposed by the California Democratic Party[18] and YIMBY Action, a pro-urban density group.[19]

Arguments of Opponents[20]

Opponents say Prop 5 would:

- Undermine funding for schools, infrastructure, and public safety

- Reduce taxes on the wealthy

Conclusion

Voting Yes on Prop 5 would extend to all homeowners who are over 55 (or who meet other qualifications) eligibility for property tax savings when they move to a different home.

Voting No on Prop 5 would retain the current law under which only certain homeowners who are over 55 (or who meet other qualifications) are eligible for property tax savings when they move to a different home.

For more information on Proposition 5, visit:

[1] https://lao.ca.gov/reports/2012/tax/property-tax-primer-112912.aspx

[2] https://repository.uchastings.edu/cgi/viewcontent.cgi?article=1970&context=ca_ballot_props

[3] https://www.sccassessor.org/index.php/tax-savings/transferring-your-assessed-value/senior-citizen-over-age-55-outside-county

[4] http://www.boe.ca.gov/proptaxes/prop60-90_55over.htm#Description

[5] https://oag.ca.gov/system/files/initiatives/pdfs/fiscal-impact-estimate-report%2817-0013%29.pdf

[6] Ibid.

[7] https://ballotpedia.org/California_Proposition_5,_Property_Tax_Transfer_Initiative_(2018)

[8] https://oag.ca.gov/system/files/initiatives/pdfs/fiscal-impact-estimate-report%2817-0013%29.pdf

[9] https://ballotpedia.org/California_Proposition_5,_Property_Tax_Transfer_Initiative_(2018)

[10] https://oag.ca.gov/system/files/initiatives/pdfs/fiscal-impact-estimate-report%2817-0013%29.pdf

[11] Ibid., along with following numeric analysis

[12] Ibid.

[13] http://cal-access.sos.ca.gov/Campaign/Committees/Detail.aspx?id=1400190&session=2017

[14] https://ballotpedia.org/California_Proposition_5,_Property_Tax_Transfer_Initiative_(2018)

[15] https://ballotpedia.org/California_2018_ballot_propositions#Positions_of_political_parties

[16] https://ballotpedia.org/California_Proposition_5,_Property_Tax_Transfer_Initiative_(2018)

[17] http://cal-access.sos.ca.gov/Campaign/Committees/Detail.aspx?id=1407354&session=2017

[18] https://ballotpedia.org/California_2018_ballot_propositions#Positions_of_political_parties

[19] https://ballotpedia.org/California_Proposition_5,_Property_Tax_Transfer_Initiative_(2018)

[20] Ibid.